PowerXchange Attendees Ask About Broadband Partnerships

Randy Sukow

|

NRTC Broadband Solutions’ Aaron Bennett, VP, Broadband Development, was in the spotlight yesterday during an “ask the experts” panel session at NRECA’s PowerXchange conference. Online participants had the opportunity to ask questions about any aspect of broadband construction and network operation. Many of the questions centered around how to get started by forming partnerships.

One attendee’s electric cooperative, for example, had begun investigating a broadband project, but another entity had already won support through the Rural Digital Opportunity Fund (RDOF) reverse auction to build service in its area. Many funding programs do not allow additional funding in areas that already have RDOF or other forms of federal support. The cooperative already has contacted that RDOF winner to explore the possibility of a partnership but was curious about what it should do next.

Bennett advised starting with a feasibility study to gather the background details needed to negotiate a solid partnership agreement. “It would help you understand the burden on each partner,” he said. “Once you understand what feasibility looks like, you can break up what the partner might like to own and operate and take responsibility for and what you might do.”

An NRTC feasibility study, he said, uses electric meter locations to define potential service points and develop a preliminary network design to calculate how much fiber optic cable, electronic equipment and other components the co-op would need to cover a rural area. The study also includes a competitive analysis of what internet services already exist in the area to help set service pricing and estimate likely take rates. Finally, the study includes a 20-year financial model, estimating likely ongoing capital and operational expenditures.

Another session participant said his co-op already had completed a study and determined that service in his area was feasible. He asked whether other cooperatives are building and owning fiber networks and then leasing capacity to telephone companies or other third parties to manage service to the home.

“We have almost a dozen scenarios where we’re working on partnerships exactly as you describe,” Bennett said.

In this case, negotiations should concentrate on what specific responsibilities each partner would be responsible for performing. “What we can help you with, taking your existing model, is sectioning off each of those pieces,” Bennett said. “We call that a RACI model, which is a fancy way of saying a roles and responsibility matrix. We do that both on the capital side as well as the operational expenses side so that we have both parties understanding the investment and return on investment.”

There was also interest in the current state of satellite broadband technology. One participant wanted to know whether NRTC still offers it members the chance to market Viasat service using geosynchronous satellites and if it had any plans to offer access to SpaceX’s Starlink low earth orbiting (LEO) service.

NRTC does offer Viasat and integrates the technology into the feasibility study. First NRTC looks for ways to drive fiber plant as deep into a cooperative’s service area as economically possible. In areas where fiber does not make economic sense, it seeks alternative last-mile fixed wireless links from the fiber backbone to the home. In extreme cases, “satellite is probably the best option in areas that have more miles of plant than meters,” Bennett said.

As for Starlink, Bennett said that NRTC has contacted SpaceX but the company is not interested in distribution partnerships at this time. “We will continue to stay in touch with them. We do think there is applicability for LEOs in rural America,” he said.

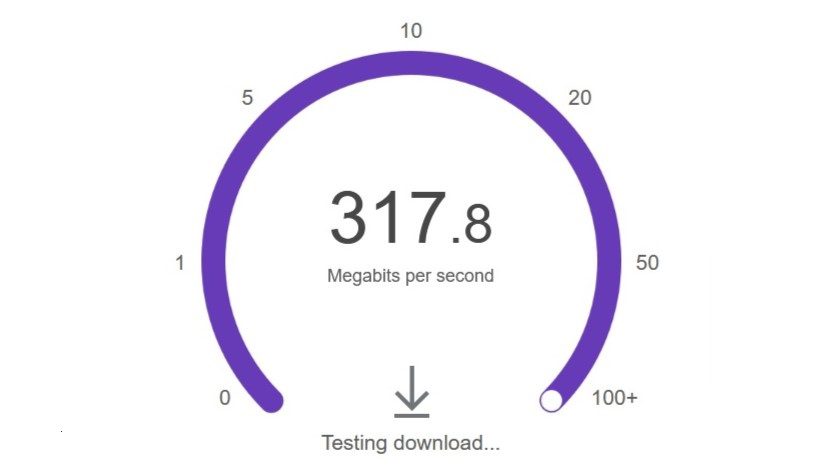

NRTC and NRECA submitted a paper to the FCC last month criticizing the Commission’s awarding RDOF funds to LEO carriers, such as Starlink, bidding in the “above baseline” (100 Mbps downstream) tier. “While delivering broadband service at the speeds promised by these applicants may appear to be viable, this service is currently in beta testing and commercially available on a limited basis in extremely limited areas, and questions remain,” the paper said.