USTelecom Panel Discusses Permitting, Raising Capital for Fiber Networks

Randy Sukow

|

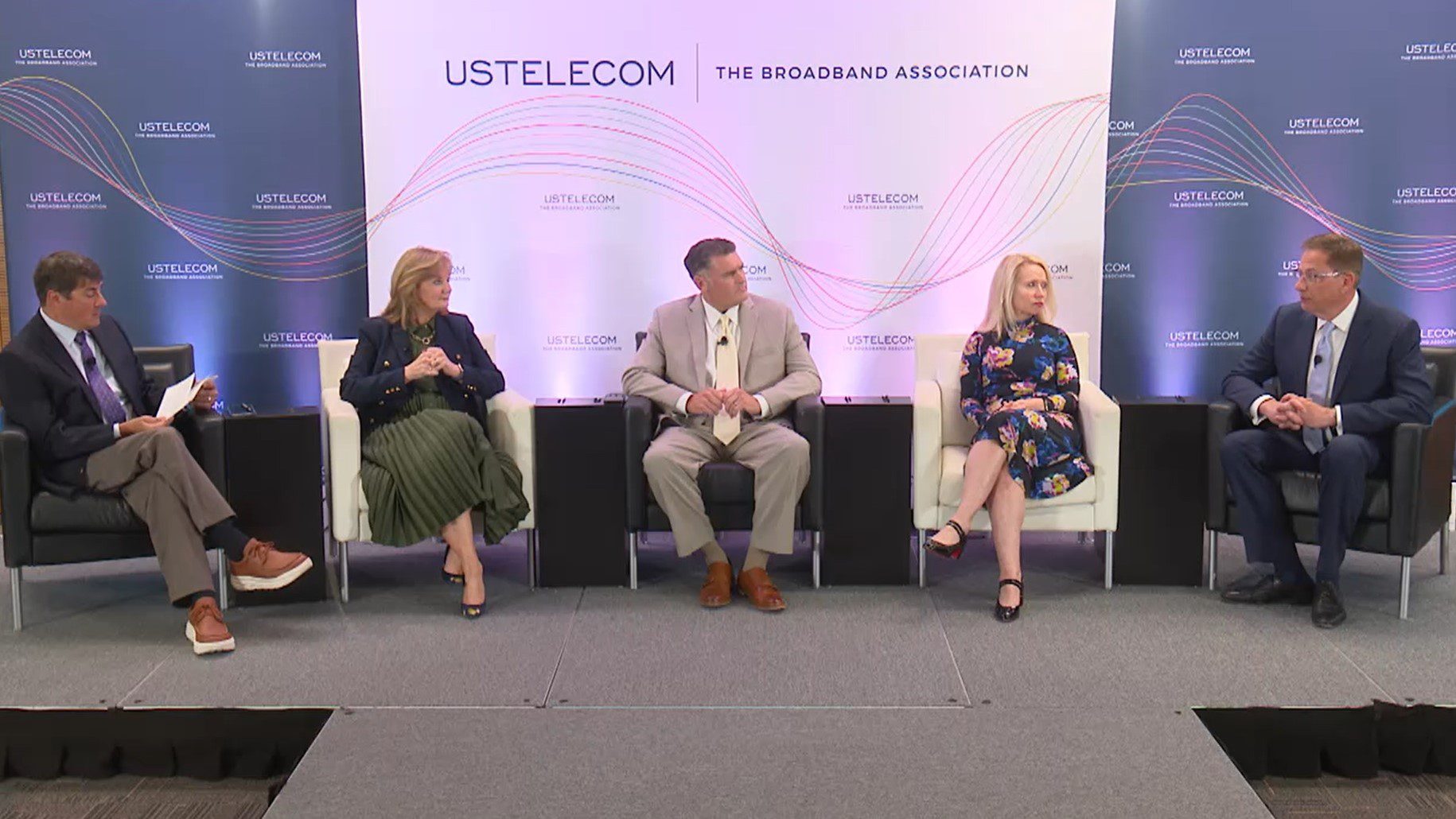

Panelists at USTelecom’s Broadband Investment Forum included (l-r) Jason Williams, Blackfoot Communications; Rhonda Johnson, AT&T; Eric Cramer, RiverStreet; Kathy Grillo, Verizon, and Bob Udell, Consolidated Communications.

A panel of telecommunications executives yesterday named their top concerns for the industry as they looked at the current Broadband Equity, Access, and Deployment (BEAD) funding activity and anticipate how to meet future demand for broadband capacity on their fiber networks.

“I think we’re at a once-in-a-lifetime inflection point … changing the connection to end users from a metallic cable to fiber and wireless spectrum,” said Bob Udell, president and CEO of Consolidated Communications in Texas, during the Broadband Investment Forum, a webcast hosted by USTelecom – The Broadband Association. “I think the future holds an environment where fiber continues … to expand into even more rural areas.”

Asked what types of challenges keep him up at night, Udell pointed to local permitting regulations. He worries about “the unexpected when it comes to putting construction plans together … If it’s not a local and community government partnership, you have more challenges in permitting,” he said. “That’s a variable and you don’t know what the timeline is going to be. That makes construction very difficult.”

Earlier in the webcast, Senator Jacky Rosen (D-NV) said that “permitting” and “streamlining” are two of the words she hears most when broadband topics arise. She noted that about 80 percent of her home state is public land and that most permitting there involves large energy and mining projects applying through the Department of Defense, Department of Energy, Bureau of Land Management, and others. She held out the hope that Congress could consider leaner rules for fiber construction.

“I am willing to work with anyone anywhere to give them all the information about the alphabet soup of Nevada and why we can think about this issue a little bit differently than the others,” Rosen said.

Panelist Eric Cramer, president and CEO of RiverStreet (originally Wilkes Telephone Membership Corp.) in North Carolina, said raising capital for fiber construction presents further challenges. RiverStreet is conducting a $500 million project to build fiber to 200,000 rural locations. “We’ve received $474 million in grants, but that’s over time, and they’re different programs,” he said. Various federal broadband programs pay out in different timelines and have different construction deadlines. Meeting all those obligations will involve raising another $150-$170 million, he said. “We obviously can’t do that on our own.”

Udell praised the partners involved in Consolidated’s current fiber builds and said that capital has not been a concern so far. “The challenge has been making sure you manage the supply chain. Right now, I think fiber is becoming a precious commodity again, and so being in the BEAD era, next year, you’re gonna start having some constraints,” he said.

Cramer also said that current taxation of grant revenue for broadband projects is also pressing their budget. Jason Williams, CEO of Blackfoot Communications in Montana, who moderated the panel, said permitting, raising capital and grant taxation, “are the same issues that have me up at night.”

Williams also said that “a lot of us are in the process or have transitioned our networks to fully IP networks, yet there are some that still believe we need to maintain these copper networks and the legacy rules around these copper networks.” He asked the panel about the challenges they face to modernize their networks.

Kathy Grillo, Verizon senior VP, Public Policy and Government Affairs, and Rhonda Johnson, AT&T’s executive VP, Federal Regulatory Relations, both praised FCC Chairman Brendan Carr’s efforts to hasten copper retirement. “One hurdle, however, that will still exist for some of us are state rules, regulations, and laws that require companies to keep the copper network in place, or at least make it really difficult to move to all IP, move to fiber, or even have customers use of wireless voice in some cases,” Grillo said.

Johnson said that AT&T is working to communicate more closely with state regulators to clear up “misconceptions” about copper replacement and to convince them that all-IP networks will be a net benefit for consumers.

“Most people don’t know we’ve got these old DSL copper networks that are out there, and providers are spending literally billions of dollars a year maintaining these copper systems. In fact, we’re running out of the engineers that even know how to work on those systems,” Carr said earlier in the webcast. “We have rules on the books at the FCC that requires you to keep doing that, even when these same providers want to shift those billions of dollars over into new high-speed builds.”

The agenda for the Commission’s Oct. 28 meeting includes a Notice of Proposed Rulemaking to encourage all-IP switching for voice communications.